Most of us have at least a basic idea of what we should be doing with our money:

1. Track your spending… by hand

I’ve used Mint, YNAB, and other money tracking tools and I think they’re all great. It’s so easy to sit down at the end of the month or year and see how much you spent, and where.

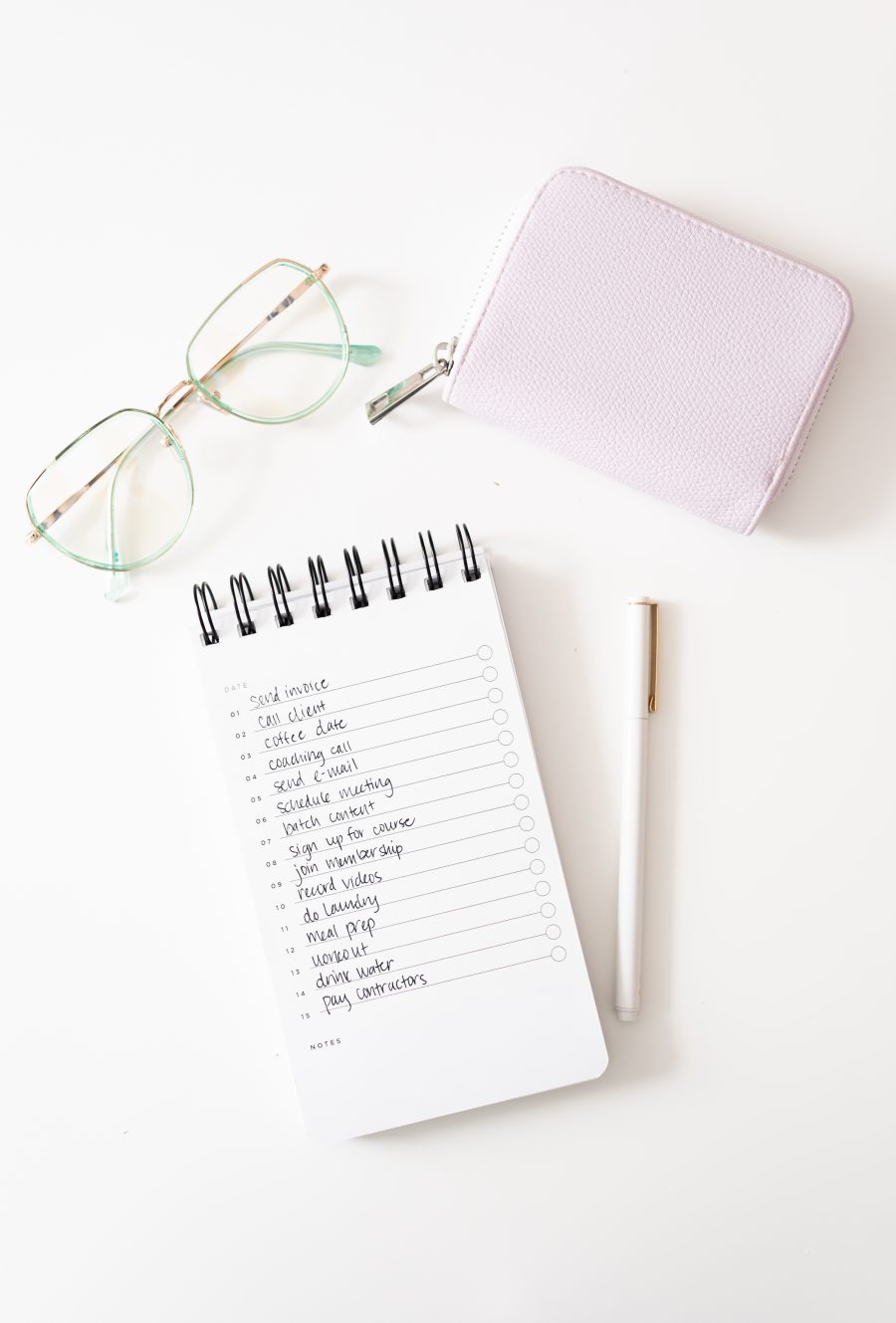

A few months ago, I challenged myself to track my spending by hand, in real time for a month. I carried around a little notebook and right after I spent money on something, I’d write it down. It was tedious, yes, but so eye-opening. I knew that I pretty much eat my budget each month, but by tracking things by hand and recognizing when I was spending money, I was able to dial things way back and cut back on some of those mindless splurges.

Try it for a week or two and see if you notice any spending behaviors that you want to change.

2. Do a no-spend month

A no-spend month is a great way to reset habits and save some extra cash quickly. The idea is that for one full month, you don’t spend any money other than on a few necessary things like rent, transportation, and basic groceries. If you really want to go big, track each purchase that you make during that month—you’ll be very in-tune with your spending habits.

Before you start your no-spend month, pick a month where you don’t have obligations that are going to make this impossible. Then write down a list of your exceptions—the things you will allow yourself to spend on for the month. This will normally include rent, fixed expenses like your phone bill and internet, and very basic groceries. Lastly, write down a list of free activities that you can do so you don’t need to feel like a shut-in for 30 days.

If this sounds easy, trust us, it’s not. It’s challenging to still remain a social person while eschewing after-work drinks to find an activity that costs $0.

Source: ColorJoy Stock

3. Read (or listen to) one money-related topic each week

Very few of us learned about money in school, but there’s no reason we can’t play catch up now—and we have all of the resources that we need right at our fingertips. Challenge yourself to learn one new thing about money each week. Read an article about investing, listen to a podcast about real estate, or pick up a basic personal finance book (my current favorite: The Simple Path to Wealth by JL Collins).

Even just thinking of a question that you don’t really understand the answer to and googling it can give you great information. Don’t feel like you need to take a deep dive into personal finance—building up your knowledge slowly is a great place to start.

4. Set up a monthly review process

When my husband and I were dating, he would take a few hours each month to, in his words, “do his finances.” We were 22, earned very little, and I had no idea what he could possibly be looking at.

I finally asked him to walk me through what doing his finances entailed, and we went through his thorough and pretty magnificent monthly review process. When we got married we set up our own monthly check-in, which includes:

- Reviewing spending from the past month to check for fraudulent charges or mistakes, and make sure our spending isn’t wildly out of line

- Looking at savings accounts and debt and see if we’re making progress towards goals

- Talking about upcoming big purchases

- Paying bills, canceling subscriptions, and any of the other random to-do’s that pile up during the month

Your monthly review process will likely look different, but challenge yourself to spend a little time each month just looking at your money. If you want to be good with money, the best place to start is to understand your financial situation.

Source: ColorJoy Stock

5. Auto-escalate your savings

Want to challenge yourself to save more money without actually having to do anything? Many 401k plans will offer auto-escalation—that is, they’ll automatically increase the amount that you’re stashing away for retirement each year. Here’s why this is great: you don’t have to think about whether you can afford to save more—it’s taken out of your paycheck for you. Research shows that people who enrolled in auto-escalation ended up saving more than people who didn’t.

So dig up your retirement plan paperwork and find out if you can enroll in auto-escalation.

6. Adopt the 72-hour rule

I used to have an impulse shopping problem, most specifically with one retailer: Amazon. They make spending money way too easy.

The 72-hour rule helped me break this. If I’m considering buying anything other than necessities, I have to wait 72 hours before I let myself press buy. I’ll add things to my cart and if I still want it after 72 hours and I can afford it, I get it. It’s simple, but not easy. Enacting this rule has created a huge shift on what I buy and how much stuff I bring into my house.

If you want to be better with money, just pick one thing on this list to challenge yourself with. When it comes to money, small changes can really lead to big results.